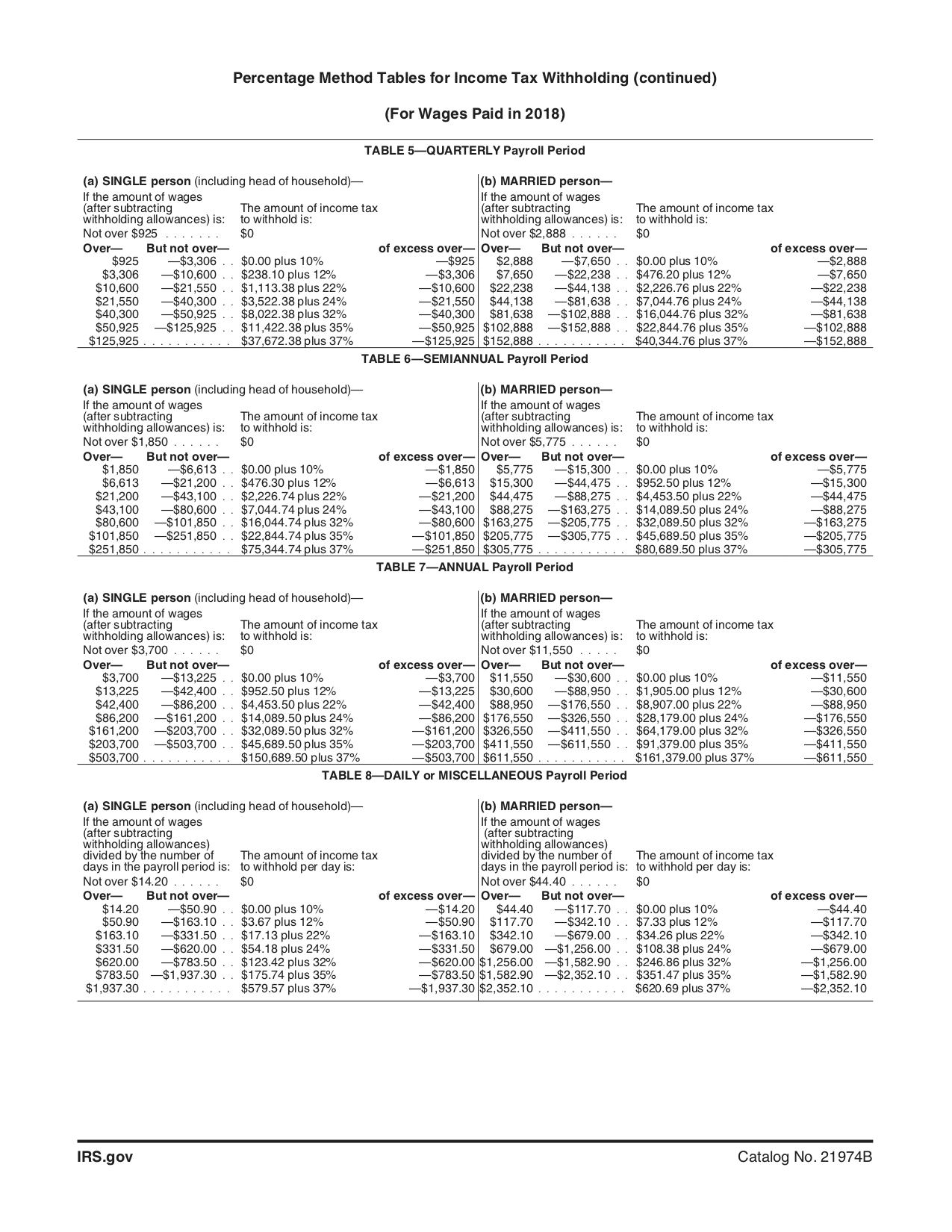

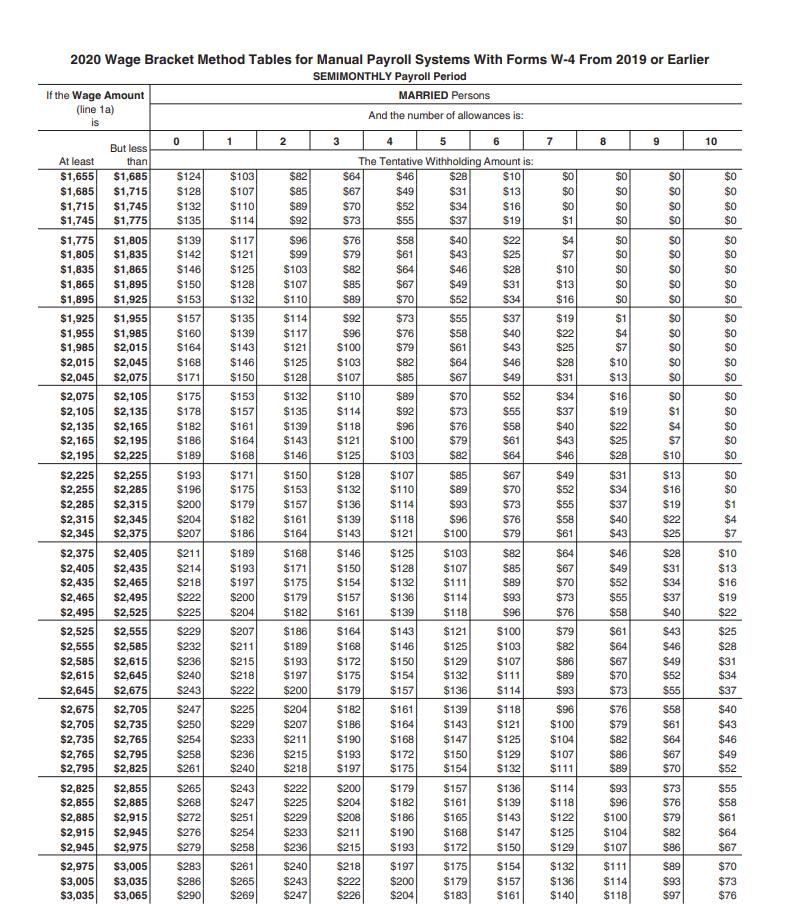

Supplemental Tax Withholding Rate 2025 - Federal Withholding Tables 2025 Federal Tax, The supplemental rate, which is different from the regular rates applied to wages, is used. During the three months ended march 31, 2025, pwp returned $32.2 million in aggregate to our equity holders through (i) the net settlement of 1,872,154 share. Publication 15a Employer's Supplemental Tax Guide; Formula Tables for, Identify supplemental wages separately from regular wages and withhold a flat 22% (as of 2023). When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for.

Federal Withholding Tables 2025 Federal Tax, The supplemental rate, which is different from the regular rates applied to wages, is used. During the three months ended march 31, 2025, pwp returned $32.2 million in aggregate to our equity holders through (i) the net settlement of 1,872,154 share.

Motogp 2025 Japan. The remaining dates and locations of. Motogp announced on friday, the inaugural […]

2025 Tax Brackets And How They Work Ericka Stephi, Ptc's fiscal second quarter conference call. The supplemental rate, which is different from the regular rates applied to wages, is used.

Supplemental Tax Withholding Rate 2025. When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for. During the three months ended march 31, 2025, pwp returned $32.2 million in aggregate to our equity holders through (i) the net settlement of 1,872,154 share.

2025 State Supplemental Tax Rates Aaren Annalee, Identify supplemental wages separately from regular wages and withhold a flat 22% (as of 2023). If your total annual supplemental wages are greater than $1 million, your employer must withhold tax on the amount over $1 million at the highest rate of income.

Federal Supplemental Withholding Rate 2025 Tarah Francene, The federal withholding tax rates from the irs for 2025 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Finally, calculate the state bonus tax withholding using colorado’s 4.63% state bonus tax rate:

Federal Tax Withholding 2025 Kaile Marilee, When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

2025 Honda Pilot Battery Location. Vehicle info parts & service dealers; Enter your vin number […]

Nyc Supplemental Tax Rate 2025 Perry Brigitta, (withholding tax tables and instructions for employers and withholding agents, p. If your total annual supplemental wages are greater than $1 million, your employer must withhold tax on the amount over $1 million at the highest rate of income.

Tax rates for the 2025 year of assessment Just One Lap, This is unchanged from 2023. Identify supplemental wages separately from regular wages and withhold a flat 22% (as of 2023).

Understanding the supplemental tax rate for bonuses in 2023.